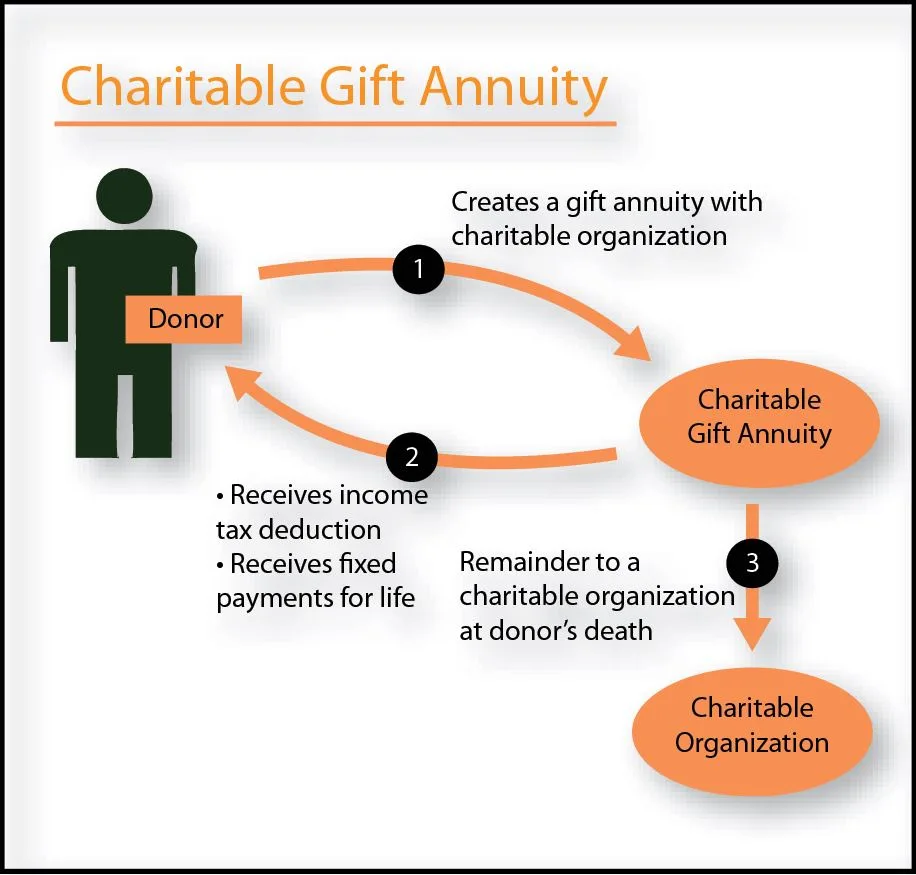

Charitable Gift Annuities are powerful tools to receive a steady stream of income guaranteed for life and make a substantial charitable contribution. The annuity can be a single life or two life annuity.

Through a Charitable Gift Annuity, a donor can do the following:

- Make a charitable gift – many times 30-40% of the original annuity

- Receive a steady stream of income for life

- About 75% of the annuity tax free for a certain period of time

- Remove the entire amount of the gift from donor’s estate

- If all goes according to plan, donor and the charity will receive an amount approximately the original donation plus earnings

For more information contact Ed Weston