For over 150 years, the Preachers’ Aid Society and Benefit Fund has provided clergy, their spouses, and any dependent children with tangible and emotional support through counseling, consultation and fellowship. Our community members enjoy quality of life as we help them continue to inspire others whether active clergy or retired. Our quality assistance programs meet their comprehensive needs from eldercare and insurance to legal and financial. Our fellowship groups, banquets and trips offer socializing and networking for retired clergy and their spouses.

Register Now for 2024 Illinois Great Rivers Annual Conference

The 2024 Annual Conference will be held on Thursday, June 6 to Saturday, June 8 at the Peoria Civic Center.

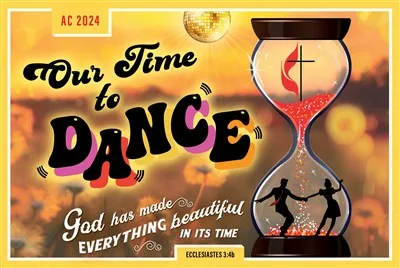

The theme is Our Time to Dance, taken from Ecclesiastes 3:4b.

The purpose of the annual conference is to make disciples of Jesus Christ by equipping its local churches for ministry and by providing a connection for ministry beyond the local church. The annual conference consists of clergy and lay members. Clergy membership consists of deacons and elders in full connection, probationary members, associate members, affiliate members and local pastors under full-time and part-time appointment to a pastoral charge. The lay membership of the annual conference shall consists of professing members elected by the charge, diaconal ministers, deaconesses, home missioners, the conference president of United Methodist Women, the conference president of United Methodist Men, the conference lay leader, district lay leaders, the conference scouting coordinator, the president of the conference young adult organization, the conference youth organization, the chair of the annual conference college student organization, one young person between the ages of 18 and 30 from each district and one young person between the ages of 12 and 17 from each district (¶601, 602.1,.4, The Book of Discipline, 2016).

The annual conference is the basic unit of the connectional system and refers both to a yearly meeting of its members as well as the organizational structure that equips local congregations to do its ministries and provide a connection beyond the local church. Pages organized under the Annual Conference will include information on the annual conference session. Pages organized under Conference will include those committees and entities that are organized at the conference level.

Online Donations Now Accepted!

You may now give safely and securely to PASBF online through PayPal! Simply click on the Donate button below, easily and safely online!